Russia’s first rating assessing the energy transition potential of major Russian companies. The rating is a new step in the analysis of the green economy and ESG development in Russia. It highlights the leaders in the energy transition to renewable and low-carbon energy sources.

Energy transition rating

What is the energy transition readiness rating?

The energy sector has a key role to play in achieving the sustainable development goals. Companies need to actively integrate ESG criteria to keep up. A fourth energy transition is now on the way around the world, which involves abandoning oil, coal and even gas in favour of renewable energy sources – solar, wind, water, biomass, geothermal, etc. According to BloombergNEF, in 2021, companies and governments invested a record $755 billion in the energy transition, with most of the investment going to renewable energy – $366 billion (+6.5% compared to 2020) and electric transport – $273 billion (+77%). Moving away from conventional energy requires a major overhaul of all existing industrial and infrastructure systems. In our energy transition readiness ranking, we looked at the 50 largest industrial holdings with revenues of more than RUB 50 billion. In many ways the entire Russian economy depends on how quickly they make the energy transition. These companies are systemically important and highly significant for the regions where they operate, as well as consuming enormous amounts of energy due to their scale. The energy transition readiness rating reflects the level of energy efficiency of companies by assessing factors that could facilitate the transition to renewable and low-carbon energy sources. It is important to note that all companies in the ranking are leaders among Russian industrial holdings, so it is not appropriate to view the companies at the bottom of the list as outsiders. Each of the rating participants has a high potential for a successful energy transition. The top 50 showcases the largest holdings that are most ready for the transition.

Moving away from conventional energy requires a major overhaul of all existing industrial and infrastructure systems. In our energy transition readiness ranking, we looked at the 50 largest industrial holdings with revenues of more than RUB 50 billion. In many ways the entire Russian economy dependents on how quickly they make the energy transition. These companies are systemically important and highly significant for the regions where they operate, as well as consuming enormous amounts of energy due to their scale.

The energy transition readiness rating reflects the level of energy efficiency of companies by assessing factors that could facilitate the transition to renewable and low-carbon energy sources. It is important to note that all companies in the ranking are leaders among Russian industrial holdings, so it is not appropriate to view the companies at the bottom of the list as outsiders. Each of the rating participants has high potential for a successful energy transition, and the top 50 are the largest holdings that are most ready for it.

Which industries are represented in the rating?

ferrous metals industry

non-ferrous metals

power generation and grid companies

oil and gas industry

chemical industry

machinery manufacturing

coal mining industry

pulp and paper , construction, non-metallic mining, other industries

To calculate the ranking we used data on 5,000 large companies from the Sustainability Monitoring database to best reflect the energy consumption by Russian industrial enterprises. The resulting list of companies has been grouped to the level of holdings.

What indicator is the rating based on?

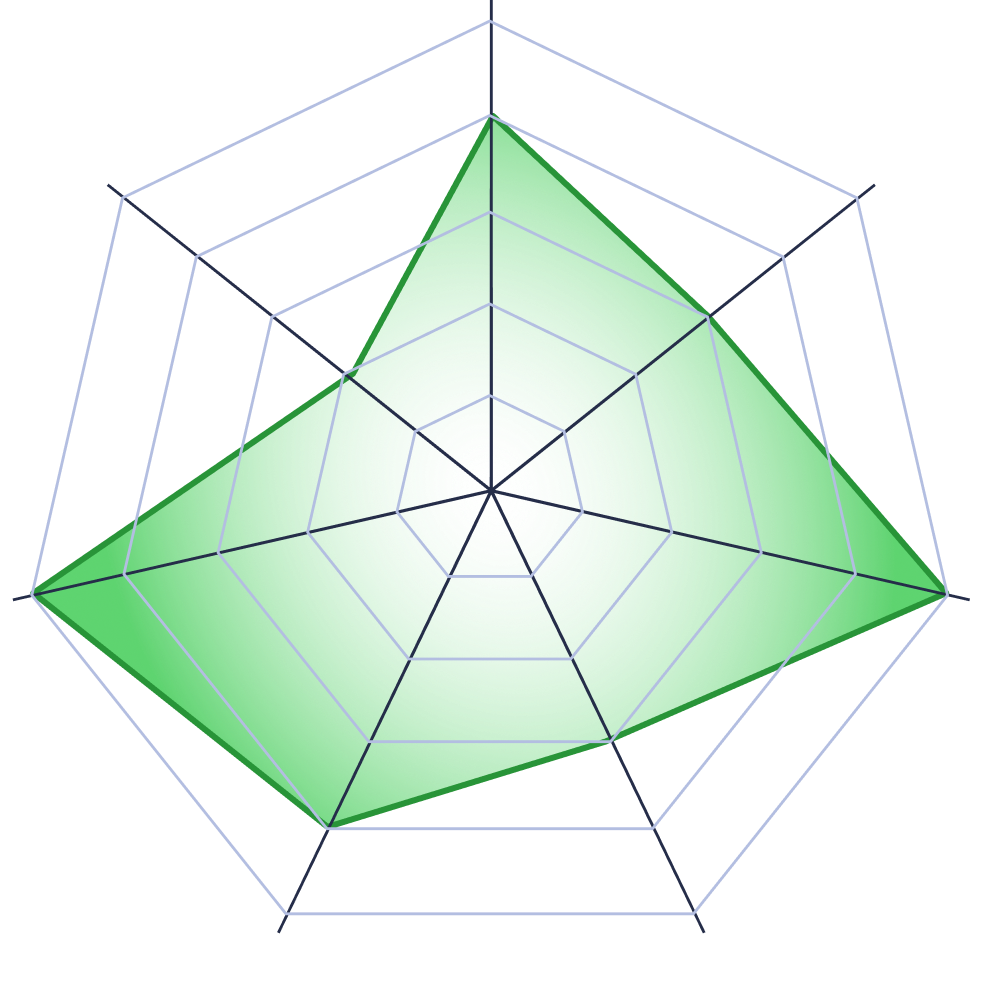

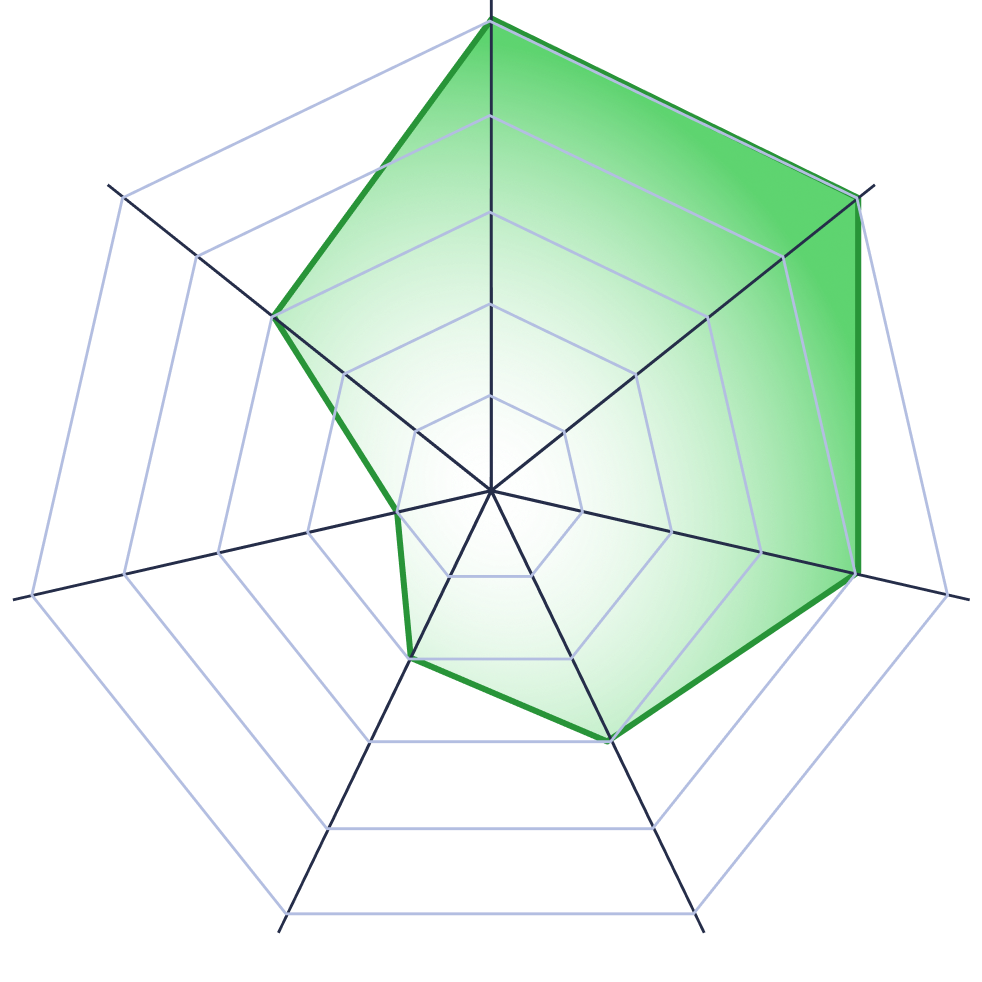

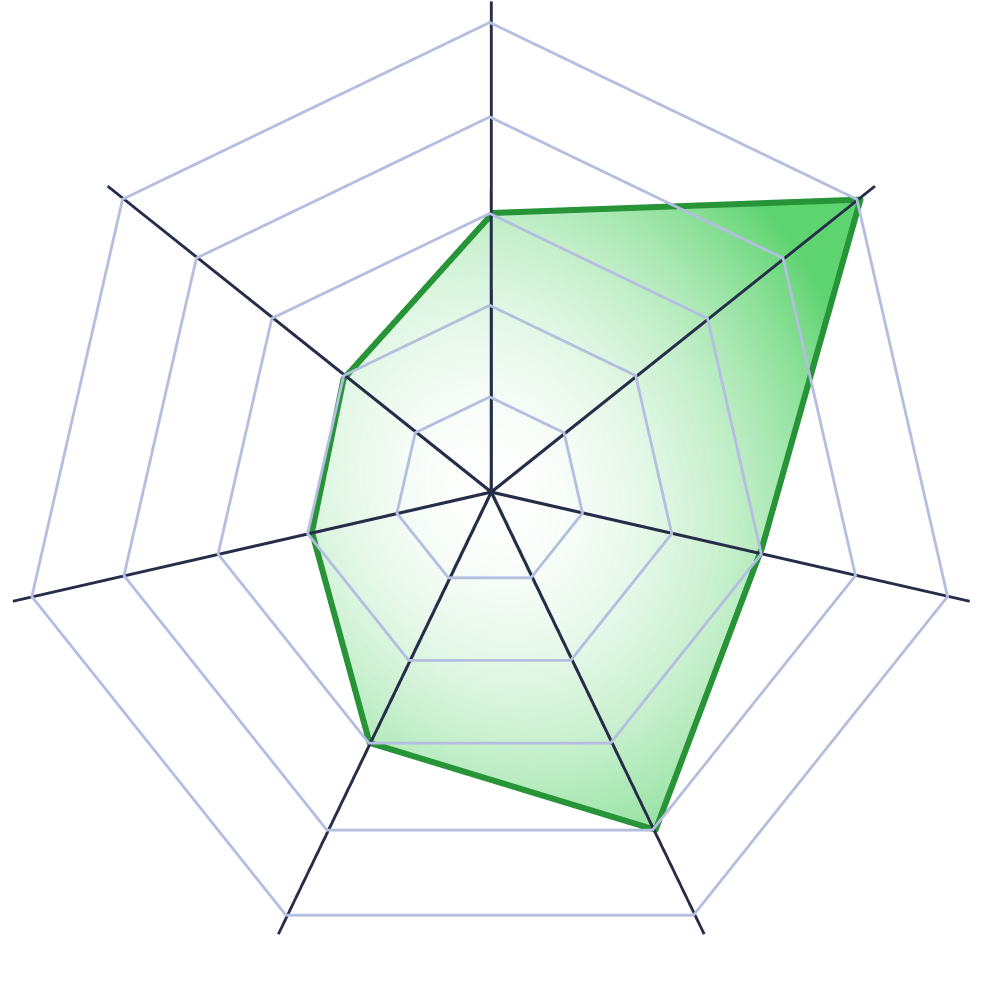

The rating consists of seven key parameters. They are reflected in the petal diagram: the further away from the centre, the higher the indicator values for a company. The parameters are also presented in the rating table as a colour scale for each holding: the more intense the colour, the higher the indicator’s value.

The criterion shows how the average annual energy intensity of stationary production (excluding motor fuels) has changed. High values indicate that less energy is needed per unit produced, meaning that companies are able to produce more without corresponding increases in energy consumption or keep production stable while decreasing energy consumption.

The parameter consists of two interrelated criteria – the total energy consumption of companies and the amount of energy from external sources. The share of total energy consumption obtained in the form of heat from external suppliers reflects the connectedness of the enterprise with the communal heating systems. The share of total energy consumption obtained in the form of electricity from external sources reflects the extent to which the production process is linked to the regional energy system. Taken together, these two criteria reflect the role of external infrastructure in the functioning of any company’s production. High values reflect the high connectivity of the company with the external energy supply infrastructure.

Reflects the mobility of technical systems (mainly through transport) in a company’s production processes. High values are given to companies whose production processes are less dependent on capital constructions and energy-intensive equipment.

The introduction of industry-specific indicators allows companies to be compared with relative averages across sub-industries, regardless of the margins and technological differences of the firm. Companies with higher revenues for each unit of energy consumed have high values.

The level of automation shows how much machine work there is per employee. Companies with a small number of employees performing a large amount of energy-intensive work have high values for this indicator.

Reflects the average annual change in the level of automation. High values are obtained by companies where the growth in energy consumption outstripped the growth in employee headcount.

A unique criterion that quantifies the number of potential combinations of transformation of a production system. This criterion reflects the ability of the system to sustain itself and evolve with the emergence of qualitatively new flows of resources and energy. The number of potential change options depends on the size of the system and the variety of elements in it. High values reflect the ability of companies to build a greater number of adaptive combinations in response to the emergence of a new type of resource, and hence are a quantitative indicator of increased readiness for the energy transition.

The transparency of companies was used as a correction factor to take into account the level of openness in terms of energy indicators disclosed over the last 5 years. This scoring system makes it possible to distinguish holdings that disclose non-financial reports in a timely manner.

Energy transition readiness rating

Position

Position

Name

Динамический ряд энергоэффективности за 15 лет

Значение внешней инфраструктуры энергоснабжения предприятий

Доля моторного топлива

Отклонение выручки на каждую единицу потреблённой энергии от подотраслевой нормы (бенчмарка)

Отклонение автоматизации труда от подотраслевой нормы (бенчмарка)

Динамический ряд автоматизации труда за 15 лет

Потенциал адаптации

1

Полюс

2

Транснефть

3

Россети

4

АЛРОСА

5

Объединенная судостроительная корпорация

6

Металлоинвест

7

Группа Илим

8

ВСМПО-АВИСМА

9

НЛМК

10

ФосАгро

11

Трубная Металлургическая Компания

12

НОВАТЭК

13

Северсталь

14

Сургутнефтегаз

15

Роснефть

16

СИБУР

17

Татнефть

18

ЛУКОЙЛ

19

ОМК

20

Норникель

21

Акрон

22

Уралкалий

23

Нижнекамскнефтехим

24

РусГидро

25

Уралвагонзавод

26

Фортум

27

Т Плюс

28

Газпром

29

Квадра

30

Юнипро

31

УГМК

32

Росэнергоатом

33

СУЭК

34

АВТОВАЗ

35

Стройсервис

36

Мечел

37

Трансмашхолдинг

38

ЕВРАЗ

39

ЕвроХим

40

РуссНефть

41

Русагро

42

ММК

43

Промышленно-металлургический холдинг

44

РУСАЛ

45

УРАЛХИМ

46

Интер РАО

47

Русская медная компания

48

Алмаз-Антей

49

СДС

50

ЕВРОЦЕМЕНТ

Top three in the ranking

The first place in the ranking is occupied by Polyus. Its leadership is largely due to its high ranking in terms of production automation dynamics and the mobility of technical systems. The weakest indicator is adaptability due to Polyus’ scale and the dispersed nature of its production sites. By purchasing international I-REC certificates, which confirm the origin of energy from renewable sources (under the power supply contract with the Sayano-Shushenskaya HPP), the gold miner compensated the part of conventional energy that could not be replaced directly. As a result, the share of renewables in the company’s portfolio increased to 100%. This made Polyus the first mining company in the world to make the green energy transition.

The second place in the ranking is taken by Transneft, whose ESG strategy places energy saving at the core of company policy. It also emphesizes a reduction of negative environmental impacts and an enhancement of social responsibility. Its position is thanks to the company’s high embeddedness in the infrastructure and high mobility. Stationary facilities are also characterised by high energy efficiency and an accelerated pace of production automation.

Rosseti receives the “bronze” in the ranking. It is not just well integrated but leads its industry. The grid infrastructure allows the company to quickly switch between conventional and renewable energy sources, provided that renewable generation is sufficiently available. Russia is now increasing the share of renewables in its energy mix. In order to effectively and safely incorporate renewables into the existing power supply scheme, new grid facilities need to be built and approaches to organising the operation of relay protection and emergency control systems need to be changed. Rosseti is already preparing for new challenges, but its energy transition largely depends on the demand for renewable energy from the grid and the readiness of generators to meet that demand.

The significance of the energy transition for the Russian economy.

Russia faces the enormous challenge of increasing the share of renewable solar and wind energy from the current 1% to 12% by 2050, improving the energy efficiency of all energy-intensive sectors of the economy and becoming a hydrogen power in the foreseeable future. But so far, most of the promising areas are in their infancy. Overall, Russian companies are just beginning the energy transition. We therefore believe it is particularly important at this stage to encourage key industries and companies in the energy transition through rankings.

A timeline of 30 years should not be deceptive; in fact, there is less and less time to make the energy transition for large corporates interested in exporting products, and major changes in external markets are putting Russia in a rather tight spot. In the coming years we will not be talking about energy transition readiness, but about the opportunities in the new green economy.